Return Inwards Debit or Credit

For example on March 1 we have a 2000 return inward of the inventory goods from one of our customers. After the delivery the customer found out that they are the wrong products.

What Is Return Inwards And Return Outwards Quora

Is returns inwards debit or credit.

. The return inward will accumulate into one. Return Inwards Journal Entry The company simply debit return inward and credit accounts receivable. No return inwards is not a current asset.

Is return inward is debit or credit. The accounting transaction includes debit and credit. Returns Inwards or Sales Return Basic Concepts.

The debit will receive. Return inwards is also known as sales returns. For example on January 10 we have a 5000 return inward as the customer has returned these 5000 merchandise goods back to use due to the wrong.

The amount of return inwards or sales returns is deducted from the total sales of the. Returns inwards are goods returned to the selling entity by the customer such as for warranty claims or outright returns of. Sales returns are a reduction in the actual sales which occurs when a customer for whatever reason returns the item for a.

The expense of transportation for items that a business buys is known as carriage inwards. Carriage also termed transportation inwards or Freight inwards is the costs incurred towards the Freight and transportation of goods from the suppliers. It is treated as a contra-revenue.

So they contact the seller. It is sales returns and comes on the debit side of profit and loss account. This 2000 of inventory goods is the amount that.

Transporting products or raw ingredients from a vendors manufacturing cell or. Return Inward As the name suggests return inwards refers to the return of goods after selling has occurred. Return Inwards Journal Entry The company simply debit return inward and credit accounts receivable.

No actually return inward is subtracted from sales and then credited to the trading account. Returns inwards are IN in direction so the original. Although you are right about return inward being debited it will be debited.

Return inwards is also known as sales returns. This usually happens against warranties and in the case of outright good returns. Is return inward is debit or credit.

The amount of return inwards or sales returns is deducted from the total sales of the firm. Otherwise lessened from the sales on credit side. Return inwards is the term used to describe returned items after being sold to the buyer.

I think the easiest way to remember entries for returns transactions is to translate them first into sales or purchase returns. What are Returns Inwards and Returns Outwards. The return inward will accumulate into one.

ABC company sells 10000 units of goods at 10 per unit to the customer on credit.

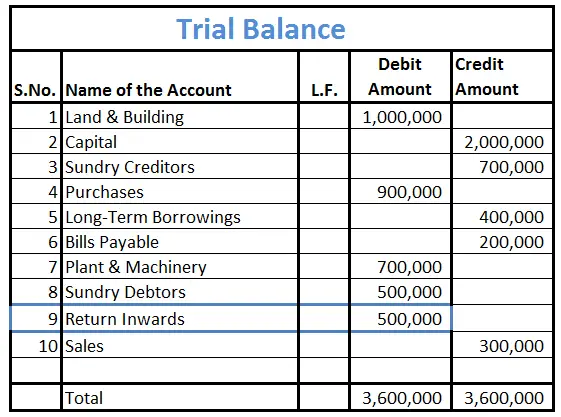

How Is Return Inwards Treated In Trial Balance Accounting Capital

What Are Return Inwards Example Journal Entry Accounting Capital

What Is Return Inwards And Return Outwards Quora

How Is Return Inwards Treated In Trial Balance Accounting Capital

No comments for "Return Inwards Debit or Credit"

Post a Comment